Trading tick offers a fresh and fast-paced path to profit. In today’s high-speed trading world, understanding it can boost your success.

This blog reveals practical insights, advanced techniques, and smart strategies to help you profit from tick-based trading.

Let’s dive right in.

Table of Contents

What Is a Trading Tick?

We’ve already covered the in-depth meaning of a trading tick in a previous blog post.

If you need a recap of its technical definition and basic structure, kindly refer to that article.

Let’s now move to its real-world application.

Why Trading Tick Matters for Profits

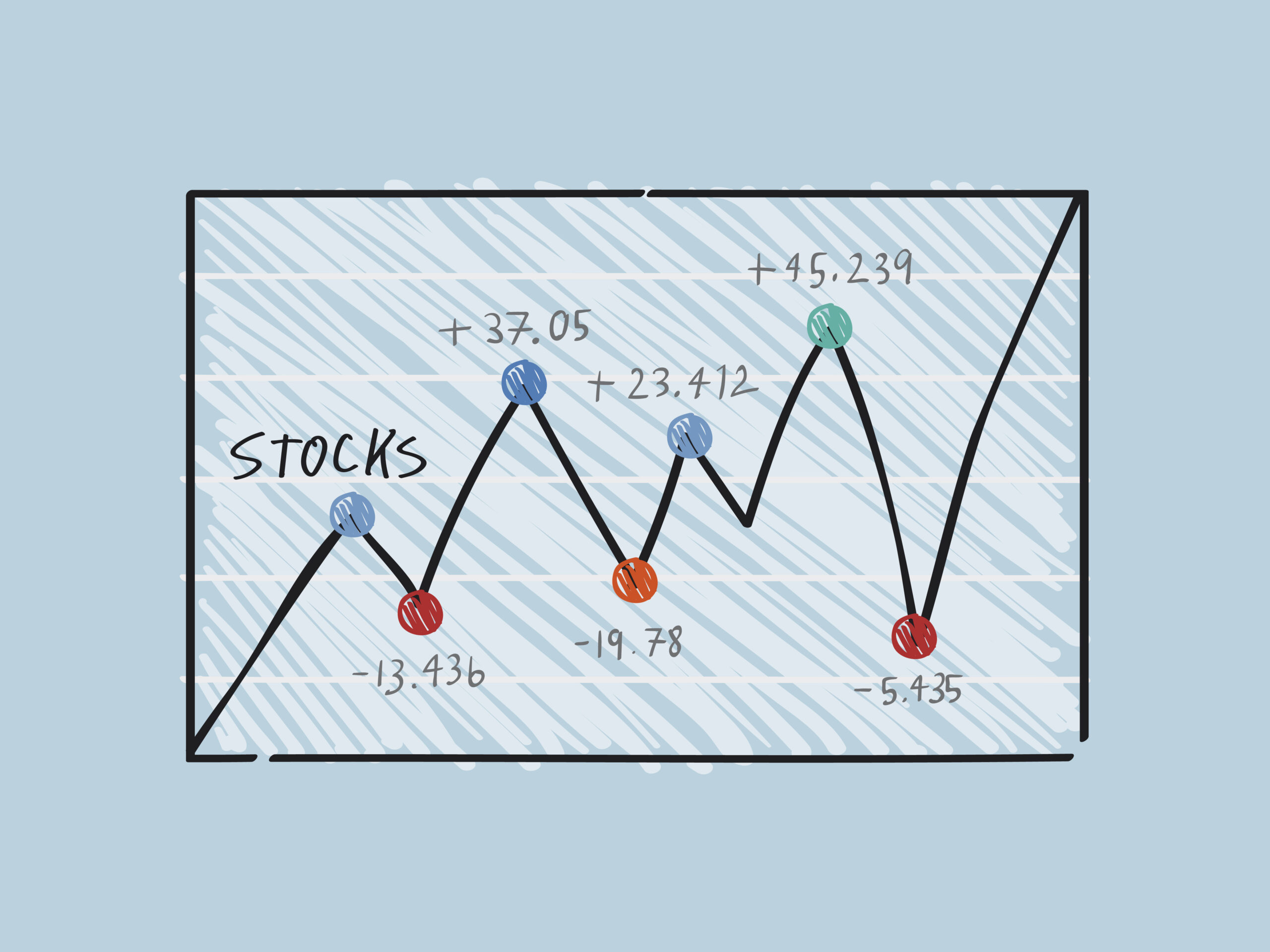

A tick marks the tiniest price fluctuation that can happen in a single trade. In fast-moving markets, even minor price fluctuations—such as a single tick—can impact trade outcomes meaningfully.

Here’s why it matters:

It shows price action clearly and instantly.

It helps traders catch tiny price shifts.

Creates more trading chances per day.

Each tick adds up. Even minor price movements during a session can accumulate into significant returns.

Scalpers and algorithmic traders rely on tick-level data for its precision and speed.

Also Read: Colour Trading

Tick Charts vs. Time-Based Charts

While time charts rely on consistent time intervals, tick charts update after a certain number of trades.

Time-based charts generate a new bar at regular time intervals, such as every minute or day.

Tick charts give more market activity detail. For example:

For example, a 233-tick chart forms a new candlestick after every 233 trades, giving you a more responsive and detailed view of price action.

It filters noise better during quiet market hours.

It speeds up during volatile periods.

This approach provides a clearer and more responsive picture of market activity.

Also Read: Options Trading

How to Start with Trading Tick

Getting started requires specific tools and trading knowledge. Let’s break it down.

Step 1 – Choose the Right Platform

Pick a platform that provides real-time tick data. Examples include:

NinjaTrader

MetaTrader 5

ThinkorSwim

TradingView (paid plans)

To use tick charts effectively, choose a trading platform that offers tick-based charting, flexible tick settings, and high-speed performance.

Step 2: Understand how tick size and value affect your trades

Every market sets its own tick size and value, with no universal standard across asset classes.

For example:

In S&P 500 E-mini contracts, every tick corresponds to a small 0.25-point price shift.

Tick value = $12.50 per contract.

Knowing how much each tick is worth helps you manage risk better and plan your profit targets more efficiently.

Step 3 – Learn Tick Patterns

Step 4 – Backtest with Tick Data

Backtest your strategy using tick-level historical data.

This helps you answer key questions:

What’s your average win per trade?

How often do setups appear?

What’s the drawdown?

Backtesting lets you trade with facts, not feelings.

Also Read: Hedging

Strategies to Maximize Fast Profits with Trading Tick

Let’s explore the best ways to turn trading tick knowledge into action.

Scalping Strategy Using Tick Charts

Scalping suits tick trading perfectly. It involves:

Fast entry and exit.

Small gains, but many trades.

Focus on momentum and breakout zones.

Use a tick chart like 233 or 377 ticks for scalping. Add volume indicators and moving averages for more edge.

Tick Reversal Strategy

Watch for quick price reversals near key levels.

Here’s how:

Set support/resistance lines.

Look for a sudden surge in ticks followed by a fast reversal before entering or exiting.

Enter with a tight stop-loss.

Secure profits by exiting the trade immediately after reaching your target. Tick reversals can bring profits fast—but they vanish fast too.

Tick Range Breakout Strategy

VWAP with Tick Charts

VWAP (Volume Weighted Average Price) works well with tick charts.

Traders can:

Buy below VWAP in uptrends.

Sell above VWAP in downtrends.

Tick charts make it easier to catch micro pullbacks near VWAP lines.

Also Read: Nifty Expiry

Common Mistakes in Trading Tick

Even experienced traders fall into traps. Here’s what to avoid:

Overtrading

Tick charts move fast. They tempt traders to trade every setup.

Set daily trade limits. Follow your plan. Avoid emotional triggers.

Ignoring Volume

Tick charts alone don’t show how much volume occurred.

Always pair them with volume indicators. Look for:

Volume spikes at reversals.

Falling volume in false breakouts.

Volume confirms which tick moves are real.

Not Using a Stop-Loss

Poor Platform Performance

Lag can ruin tick trading. If your trading platform lacks speed, you risk delayed entries and exits—potentially missing profits or increasing losses

Invest in solid internet and devices. Speed matters here.

Also Read: ETFs

Tools and Indicators for Trading Tick

The right tools improve accuracy. Here’s what to use:

Tick Volume Indicator

Shows how many ticks happened per candle. Helps spot:

Sudden action spikes.

Areas of interest for big players.

It’s simple but powerful.

Moving Averages

Try using short-term moving averages on tick charts:

EMA 9

EMA 21

These can guide entries and exits in scalping setups.

MACD for Tick Charts

MACD gives momentum clues. Pairing this strategy with tick volume helps identify clearer and more accurate signals.

Look for:

Crossovers near support/resistance.

Divergences before reversals.

Also Read: Double Bottom

Risk Management in Tick Trading

Risk is higher in fast setups. Be strict with these rules:

Set Daily Profit and Loss Limits

Decide when to stop trading—win or lose. This keeps you consistent.

Risk Per Trade: 1% or Less

Avoid Revenge Trading

If you lose, step back. Breathe. Don’t chase a loss. Most mistakes happen when emotion takes over.

Also Read: How to Spot Double Top

Advantages of Trading Tick

Let’s review why it’s so popular:

- Ultra-precise entries and exits

- Fast profit opportunities

- Less noise than time charts

- More setups per session

Tick trading is ideal for active traders who excel at making quick decisions and entering the market at optimal points.

Also Read: Sector Rotation

Is Trading Tick Right for You?

Ask yourself:

- Do you enjoy fast-paced trading?

- Can you stick to rules under pressure?

- Are you comfortable with quick decisions?

If that sounds like you, tick-based trading could suit you well.

Also Read: Gift Nifty

FAQs

Q1: What’s a simple explanation of a tick in trading?

A minimal price fluctuation that occurs in a security during one trade is called a tick.

Q2: Is trading tick profitable?

Yes, it can be. When paired with a solid plan and consistent execution, tick trading offers quick profit opportunities.

Q3: Which markets work best with trading tick?

Highly liquid markets like futures, forex, and indices are best for trading tick.

Q4: How do I read a tick chart?

Tick charts display candles after a fixed trade count, not by time. Monitor price patterns and shifts in volume to spot potential trading opportunities.

Q5: Do I need fast internet for trading tick?

Yes, analyzing real-time tick data requires fast internet and a powerful trading platform.

Q6: Can beginners try trading tick?

Q7: What’s the best tick chart setting?

Q8: Should I trade tick during news events?

Refrain from trading ticks during major news releases, as price action tends to become highly erratic and unpredictable. Stay out.

Q9: How do I calculate tick profit?

Always verify the tick size and its monetary value for the asset you’re trading. Multiply by the number of ticks gained.

Q10: Can I automate trading tick strategies?

Yes. Many traders use algorithms and bots for tick trading. But always test first on demo.

Also Read: Trading Victory